This blog was written by Dr. Maria Ron Balsera, Tax and Education Alliance Coordinator, ActionAid, ahead of a session at the UKFIET Conference on 16 September 2021 12:30-14:00pm titled Financing Education: Foreign Aid? Domestic Tax?

The consequences of the COVID-19 pandemic have been disastrous, particularly in terms of health and in economic terms, but no less for education. At a time when countries desperately need to redress the loss of learning and growing education inequalities caused by the lockdowns, two thirds of low- and lower-middle income countries have cut their education budgets. Much attention has been placed on the Global Partnership for Education (GPE) replenishment summit held in London at the end of July. The focus seemed to be on the donor pledges, which didn’t reach the $5billion target, when the bulk of the pledges actually originated from the so-called ‘Developing Countries Partners’, who committed to maintain or increase the share of their government budget allocated to education, around $196billion in total. This proportion was anticipated by the Education Commission in 2016 which stated that to meet the education financing gap, 97% of the funds would need to come from domestic resource mobilisation (DRM) and only 3% from aid or loans. So, it’s time to give DRM and aid the weight they deserve in UKFIET.

It seems a contradiction that the education aid budgets are being cut when the share of the government budget allocated to education is maintained. First, this is not always the case and we have seen some flagrant regressions even before COVID-19, for which we are still awaiting explanations. Second, if we are serious about financing education, we cannot limit ourselves to studying the share of the budget, we also need to study the size, sensitivity, and scrutiny of the budget. Using the 4Ss framework, we encourage governments to:

It seems a contradiction that the education aid budgets are being cut when the share of the government budget allocated to education is maintained. First, this is not always the case and we have seen some flagrant regressions even before COVID-19, for which we are still awaiting explanations. Second, if we are serious about financing education, we cannot limit ourselves to studying the share of the budget, we also need to study the size, sensitivity, and scrutiny of the budget. Using the 4Ss framework, we encourage governments to:

- increase the share of budgets spent on education – 20% of national budget or 6% GDP;

- increase the size of government revenues overall – by increasing the Tax/GDP ratio through progressive tax reform, (e.g. direct taxes, reviewing harmful tax incentives and tax treaties, taxing wealth, taxing the digital economy);

- increase the sensitivity of allocations within education (focusing on equity), gender and inclusive responsive budgets;

- increase the scrutiny to ensure that the funds arrive in practice and are adequately used (transparency, accountability, timely disbursement, etc).

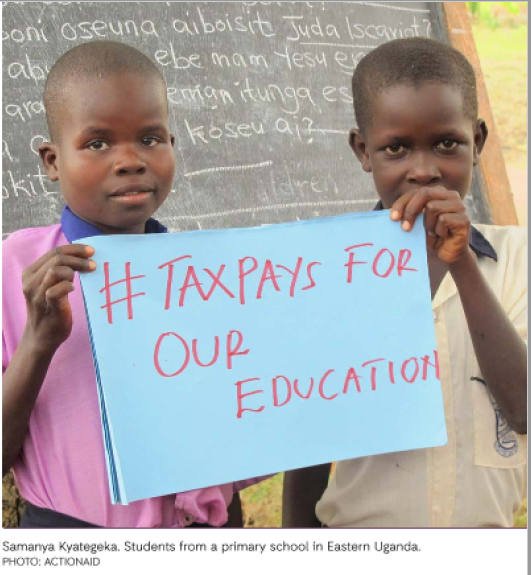

An unhealthy obsession with the share of the budget has led the education community to neglect the size. By leaving it to ‘tax experts’ we have missed the real opportunity to increase the size of the pie so that public services such as health, education, and WASH do not need to compete against each other for insufficient shares. To achieve SDG4 and the other SDGs, we need a change of domestic financing – and for that to be fair and sustainable it will need to come from progressive tax reforms.

We are delighted to have secured funding from the Global Partnership for Education’s Education Out Loud to form a transnational Tax and Education Alliance (TaxEd Alliance) that brings together ActionAid, the Tax Justice Network, the Global Alliance for Tax Justice, nominated for the 2021 Nobel Peace Prize and its regional networks – Tax Justice Network Africa and Tax and Fiscal Justice Asia, Asian Peoples’ Movement on Debt and Development – together with Education International (federation of teachers’ unions) – with close practical links with the global education movement – the Global Campaign for Education and their regional and national coalitions. The TaxEd Alliance will be focusing on Nepal, Senegal and Zambia, but we are hoping that our work will also extend to other countries.

More about the TaxEd Alliance

The TaxEd Alliance will enable civil society partners to contribute to a more strategic dialogue on domestic financing, linking particularly with Ministries of Finance, MPs and other actors. In order to achieve this change in the financing of education, the project has developed an approach that:

- establishes and builds the capacity of a new transnational Tax and Education Alliance;

- develops improved mechanisms and facilitates cross-sector dialogue that brings together Alliance members at national and regional level with government and regional stakeholders to develop innovative responses to the issues of financing for education and tax justice;

- builds a comprehensive body of research to provide evidence for policy work that will generate recommendations and commitments by government for tax and education financing reforms;

- opens up transnational policy debates to include civil society voices, links national policy setting for education budgets and tax reforms with international and regional frameworks;

- organises a comprehensive advocacy and influencing programme based on research evidence to bring about commitments by government to take action to reform domestic tax policy or practice.

The strong alliance between these civil society organisations(CSOs) and teachers’ unions will play an essential role in bringing about sustainable change in education financing policy, increasing the size and share of budgets supported by fair tax and revenue frameworks to improve decision-making mechanisms and accountability processes, by improving the scrutiny and sensitivity of the education budget. Through this alliance, we will work to ensure that the voices of citizens and marginalised groups are heard in national and international policy debates. Together, we can be the catalyst to bring governments, international organisations and CSOs together to ensure that Covid marks a positive turning point in domestic financing of education.